30+ Online payroll calculator 2021

Get a free quote today. This free paycheck calculator makes it easy for you to calculate pay for all your workers including hourly wage earners and salaried employees.

Everything You Need To Know About Running Payroll In Canada

Form TD1X Statement of Commission Income and Expenses for Payroll Tax Deductions.

. Updated September 30 2021. Use the Payroll Deductions Online Calculator PDOC to calculate federal provincial except for Quebec and territorial payroll deductions. The payroll calculator from ADP is easy-to-use and FREE.

You can enter your current payroll information and. Need Guidance Through the Online Payroll Program Jungle. This online paycheck calculator with overtime and claimed tips will estimate your net take-home pay after deductions and federal state and local income tax withholding.

Ad Does Your Online Payroll Program Spark Joy. Try it free for 30 days with no contracts or commitments and. No Need to Transfer Your Old Payroll Data into the New Year.

It will confirm the deductions you include on your. Discover ADP Payroll Benefits Insurance Time Talent HR More. Our Advisors Got You Covered.

Ad Accurate Payroll With Personalized Customer Service. It is perfect for small business especially those new to payroll processing. Taxes Paid Filed - 100 Guarantee.

Use this simple powerful tool whether your. Withhold 62 of each employees taxable wages until they earn gross pay of 147000 in a given calendar year. Discover ADP Payroll Benefits Insurance Time Talent HR More.

First determine the total number of hours worked by multiplying the hours per week by the number of weeks in a year 52. Ad Make Your Payroll Effortless and Focus on What really Matters. Free salary hourly and more paycheck calculators.

The FREE Online Payroll Calculator is a simple flexible and convenient tool for computing payroll taxes and printing pay stubs or paychecks. Form TD1-IN Determination of Exemption of an Indians Employment Income. Use this calculator to help you determine the impact of changing your payroll deductions.

The FREE Online Payroll Calculator is a simple flexible and convenient tool for computing payroll taxes and printing pay stubs or paychecks. Calculate your net pay or take home pay by entering your per-period or annual salary along with the pertinent federal state and local W4 information into. Get A Consultation Today.

The maximum an employee will pay in 2022 is 911400. SmartAssets hourly and salary paycheck calculator shows your income after federal state and local taxes. Get Started With ADP Payroll.

Ad Payroll So Easy You Can Set It Up Run It Yourself. 3 Months Free Trial. Ad Process Payroll Faster Easier With ADP Payroll.

Federal Salary Paycheck Calculator. To calculate an annual salary multiply the gross pay before tax deductions by the number of pay periods per year. Double check your calculations for hourly employees or make sure your salaried.

More calculations more accuracy and a LOT less time. Heres a step-by-step guide to walk you through. This free paycheck calculator makes it easy for you to calculate pay for all your workers including hourly wage earners and salaried employees.

Ad Compare This Years Top 5 Free Payroll Software. Time and attendance software with project tracking to help you be more efficient. Get a free quote today.

If you need a little extra help running payroll our calculators are here to help. Next divide this number from the. Free Unbiased Reviews Top Picks.

Use PaycheckCitys free paycheck calculators gross-up and bonus and supplementary calculators withholding. How do I calculate hourly rate. Ad Process Payroll Faster Easier With ADP Payroll.

Starting as Low as 6Month. All inclusive payroll processing services for small businesses. Start Afresh in 2022.

How to calculate annual income. For example if an employee earns 1500. Calculate your state local and federal taxes with our free payroll income tax calculator simply choose your state and you are all set.

Heres a step-by-step guide to walk you through. Get Started With ADP Payroll. Enter your info to see your take home pay.

Ad No more forgotten entries inaccurate payroll or broken hearts. Small Business Low-Priced Payroll Service. The online payroll calculator that does more for less.

Free 2021 Payroll Deductions Calculator. Computes federal and state tax withholding for.

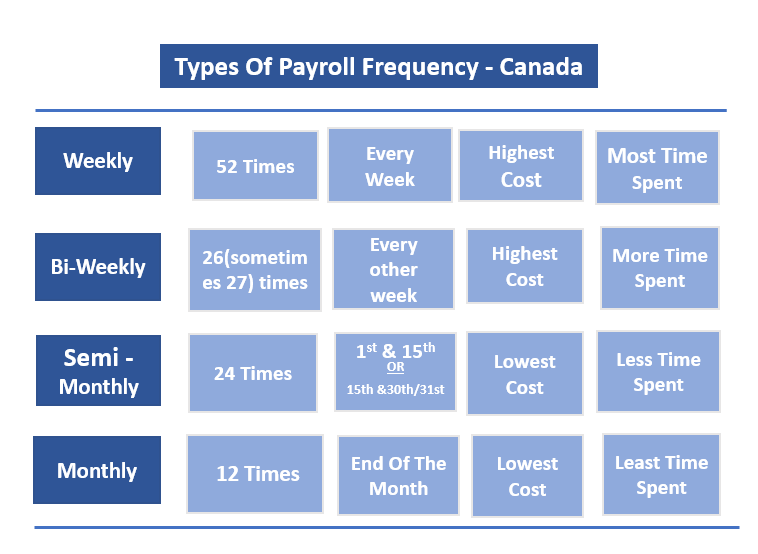

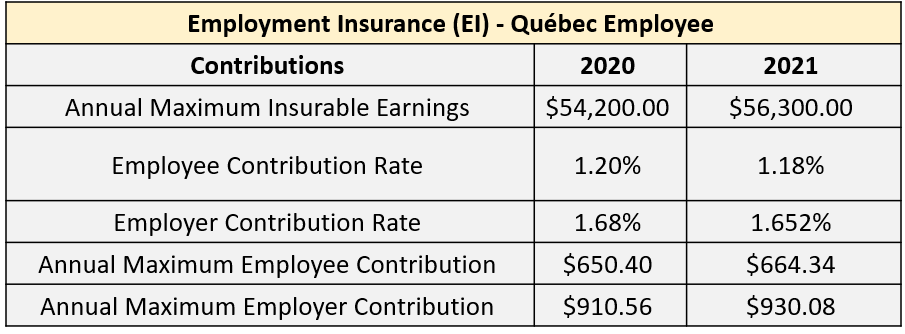

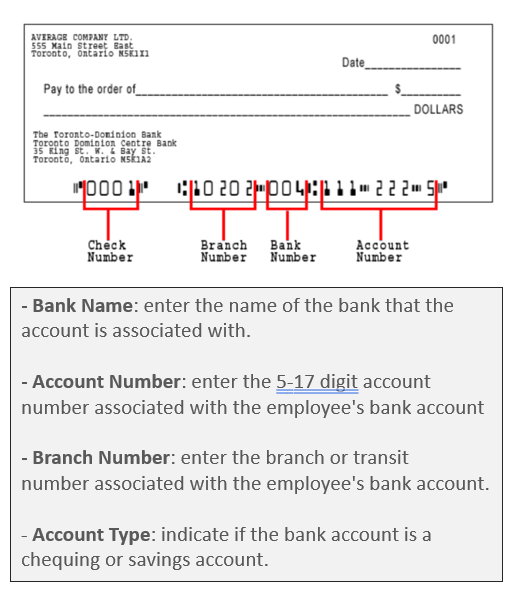

Everything You Need To Know About Running Payroll In Canada

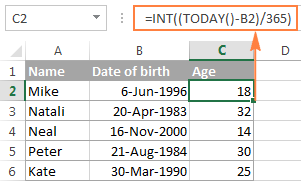

Excel Year Function Convert Date To Year Calculate Age From Date Of Birth

Amazon Com Quickbooks Desktop Pro Plus With Enhanced Payroll 2022 Accounting Software For Small Business 1 Year Subscription With Shortcut Guide Pc Download Everything Else

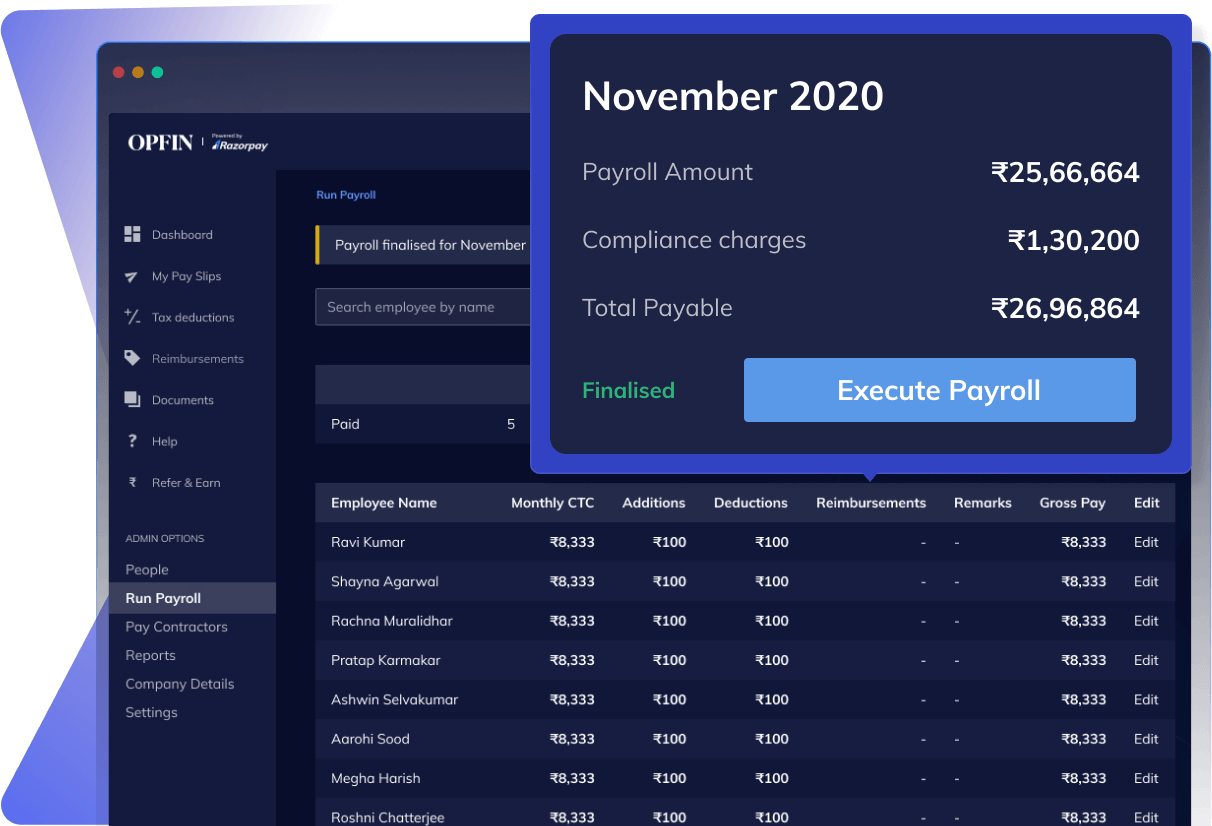

Online Payroll Processing Razorpayx Payroll

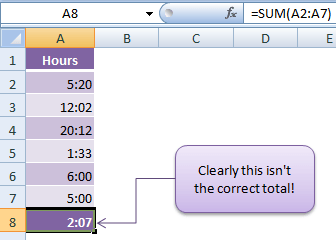

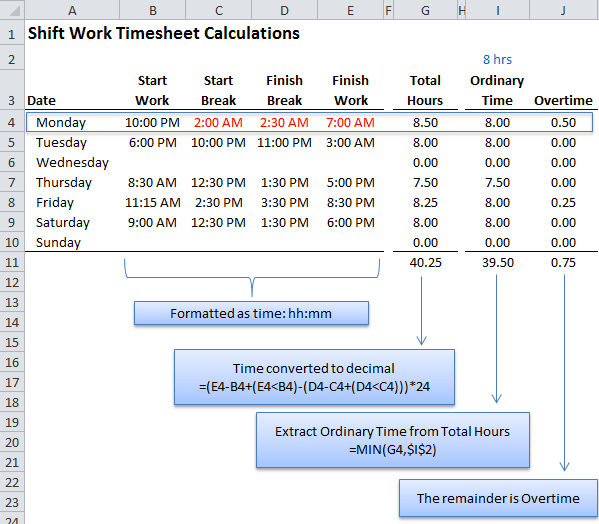

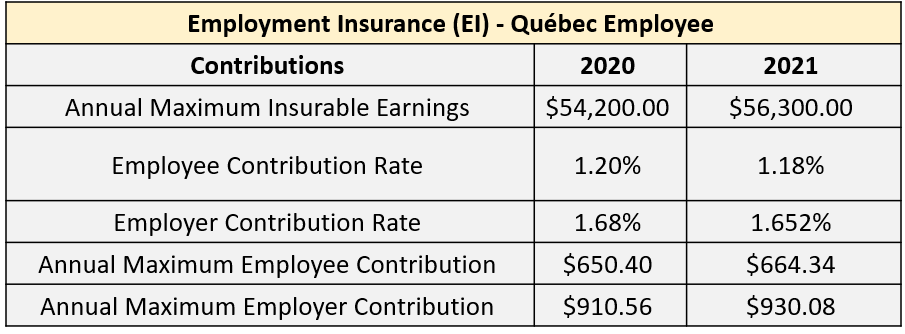

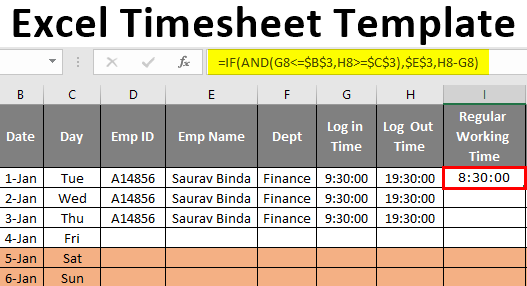

Calculate Time In Excel Time Difference Add Subtract And Sum Times

Calculating Time In Excel My Online Training Hub

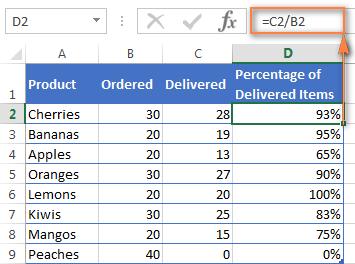

How To Calculate Percentage In Excel Percent Formula Examples

Calculating Time In Excel My Online Training Hub

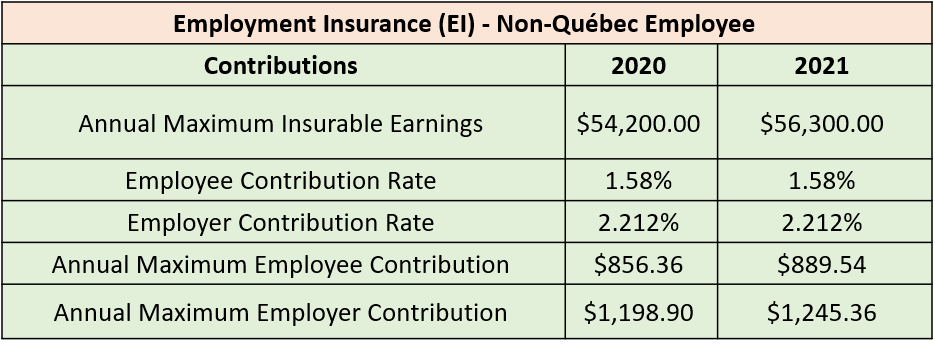

Everything You Need To Know About Running Payroll In Canada

I M Single In Nyc My Gross Bi Weekly Pay Is 1 000 W 2 Does It Make Sense That 25 Is Deducted For Taxes Quora

Everything You Need To Know About Running Payroll In Canada

Compound Interest Formula And Calculator For Excel

Free Timesheet Templates For 2021 Excel Word Pdf Running Remote

Calculating Time In Google Sheets

Israel Payroll Calculator Table Anglo List

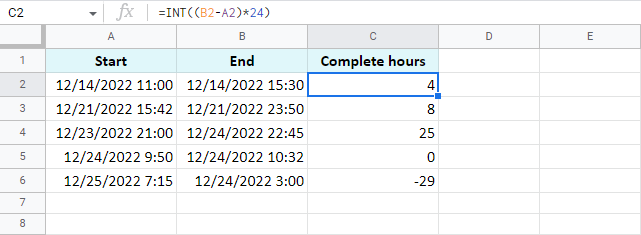

Excel Timesheet Template Creating Employee Timesheet Template

Payroll Deductions Teaching Resources Teachers Pay Teachers